Management programs are long-term permanent initiatives whose purpose is to achieve the same goal year after year. These programs have permanent structures and procedures in place with permanently assigned resources.

We’ve developed these programs for our clients over our 25 year history.

Performance Management Metrics & Ratios

“PMR” for short

Executives use this program to improve their profitability, ROI and growth.

This program assembles sets of:

Staffing Models / Workforce Management Program

Balancing & Optimizing Resources For Workloads

Staffing Models and Workforce Management Programs are the fundamental cost management methods that are used to manage costs while assuring there is sufficient resource capacity for production and distribution operations with the required levels of quality and service.

We construct AIModels that are specifically designed to provide all of the input information that is needed to create staffing models and workforce management tools and applications. We also guide executives in establishing permanent workforce management programs.

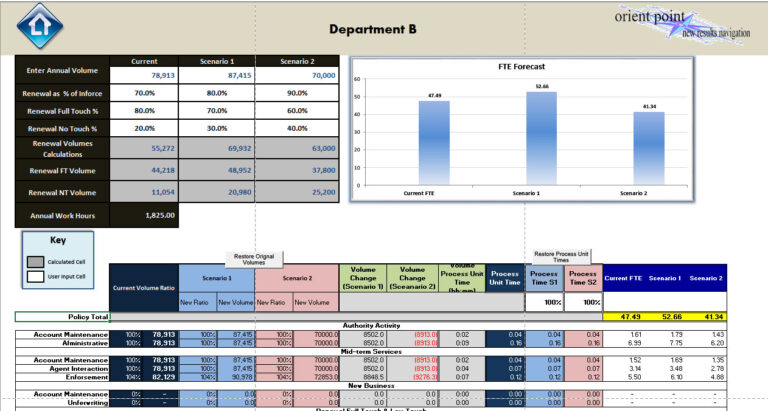

The 2 photo exhibits above are from our Workforce Management app that is used to manage resources in multi-unit operations. It determines the number of resources that are currently needed and forecasts 2 different future scenarios.

Hyper-High Performer Program, H2P2 referred to as “HP” for short, is a program that increases employee performance.

Hyper-high performers are those employees who perform well above the high performance levels. If high performers open 6 new accounts each week, hyper-high performers open 12. If high performing account executives maintain an account retention of 80% hyper-high performers have a 98% retention rate.

Most companies have a couple of hyper-high performers, and these companies never understand what the HPs do differently. We have discovered that HPs do a couple of things differently. They’re rarely smarter or better educated than other employees. They never have different attitudes and values.

Conducting AIM studies with AIModels where we can see and compare HPs activities has allowed us to discover exactly what HPs do differently. It’s always subtle, and it’s always a combination of activities, no single silver bullets.

When we discover these different activities, we document them with context exhibits and help you launch a program to inform and train all other employees about these specific HP activities.

Like ripples on a still pond, the HP activities are adopted throughout the organization and the performance of the entire group increases.

This program is for you if you have hyper-high performers and you have not successfully increased everyone’s performance by adopting the HP activities.

The chart below displays how small differences in a few activities makes a large difference in performance.

This company was able to realize over 80% of the Hyper High Performers’ stats within 6 months of implementing a HHP with training and management modules.

Growth Program

In most boardrooms, growth is the top priority and gets the most attention. Of course, profits are always on the agendas, but profitability is a given. New revenue and new profits fuel new research, new technology, new markets and bonuses that stabilize and invigorate the entire company.

”Nothing new happens until new revenue and profits are produced”.

Most directors and very many executives still believe in the myth of the “silver bullet”. They believe that one single idea will solve a myriad of growth problems and achieve numerous growth goals.

As an aside: the “silver bullet” originated with a 1940’s TV series called the Lone Ranger. The Lone Ranger used silver bullets and would shoot in ways that made the bullet ricochet off numerous points, achieving a couple of things with just one perfect shot. In business there are no silver bullet solutions. We have come to realize that the opposite is usually true and that most problems and opportunities require a number of initiatives.

We believe we know growth. We helped Citibank units double while their competitors grew less than 10%. Citi was our 3rd client and they engaged us, almost every year, for over 20 years. We helped Chubb Insurance units, Commercial Insurance, Personal Insurance and Specialty Insurance achieve and sustain growth rates that were 3 times higher than the insurance industry and their competitors. They also engaged us every year for over 20 years.

We helped AIG’s units in Europe, the Middle East, Latin America and Southeast Asia solve the operational impediments that were hindering their growth in a multi-year long term program. We led an AIG program that settled 80% of auto and health claims within 12 hours. While this was a completely operational initiative, AIG used it as the spear point of their marketing strategy. It was very successful, often producing growth rates that exceeded 20%, compared to 3 to 5% historical trends. The interesting thing about AIG’s claims growth initiative was that it was successful in every country.

During one of our Citibank projects, the AIM product cost analyses discovered a product that Citi was producing at an unusually high profit. They had automated the production and distribution processes very well and had a low cost but high-quality branch service and support operation. The entire life-cycle metrics and ratios were elegant yet Citi managers didn’t know about this opportunity.

We know growth; our approaches, methods, AIModels, tools and technologies have been proven over many years, in many cultures and countries.

We take an operational approach to growth that focuses on the production and distribution areas. We know it’s not sexy. New marketing strategies, cutting edge ad campaigns, new products and expanding into new markets are sexy. They’re also risky. They’re also expensive. They’re also slow and usually take years to break even. The consulting world is full of crystal ball readers who will appeal to your ego and sell you some fantastic growth projects. If you manage with your ego, rather than facts, these might be appealing to you.

We have “12 Growth Focal Points” that achieve new growth with mostly operational changes and transformations. We build Activity Information Models that help us find and analyze operations for the problems that are preventing your growth. Our AIModels also show us the opportunities you have for growth and blueprint the operational changes that are needed to maximize these opportunities. Most companies find that there are 2 or 3 focal point areas that offer the largest, most immediate growth improvements. We usually find 2 or 3 other focal point opportunities that are addressed later after the high priority initiatives are underway. When a company has 3, 4 or 5 growth initiatives, it usually achieves “leap scale” growth: growth levels that far exceed the usual incremental rates.

One thing distinguishes our approach and success; Our clients achieve higher growth rates faster and sustain those higher growth rates longer, than traditional growth programs.

Chubb Commercial Insurance had 12 straight quarters of organic growth that exceeded 10% after conducting 2 AIM projects to increase productivity and growth. Seven of the 12 quarters exceeded 20%. During this same period the average growth rate for the commercial insurance industry was less than 1.5 %.

If you’re not leading your industry in growth, call us to see our “12 Growth Focal Points” and how we might be able to help you too. Our contact information is the page footer below.

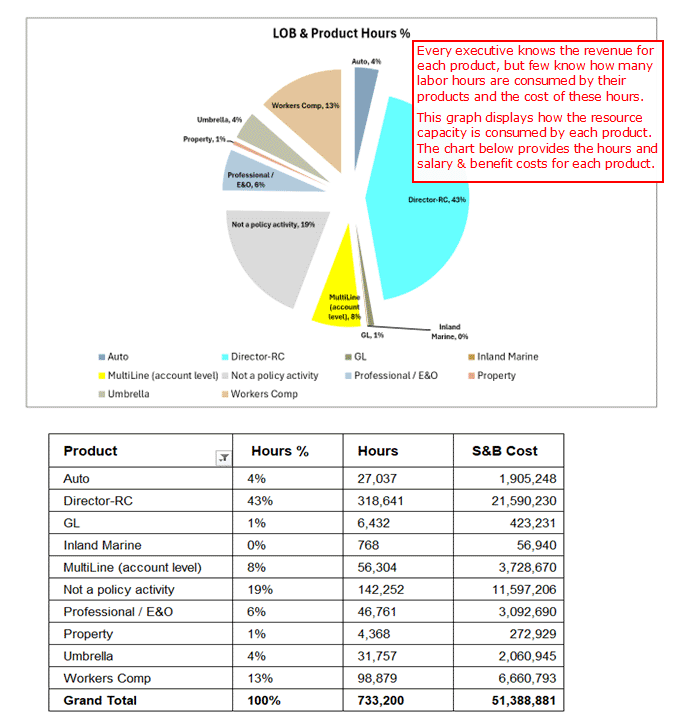

Cost models provide accounting and finance departments with information about the cost of products, customers, processes and organizational units such as branches. Preparing accurate financial reports and filings requires accurate cost models. Profits, return on investment, budgets, and tax filings all require and rely on accurate cost reports.

Traditionally, accountants have prepared cost models for labor costs by surveying, interviewing and observing employees. These methods often produce inaccurate information results for these reasons:

We build ABC (Activity Based Costing) Cost Models for accounting and finance departments. Our ABC Cost Models have more and better information than your current cost models.

Our ABC Cost Models will make your financial reports more accurate and far easier to prepare. Our ABC Cost Models will also be useful to your Marketing, Operations, IT and Human Resources managers. Finally, our ABC Cost Models will be delivered at economical costs below your current costs.

© 2024 All rights reserved Orient Point Consulting LLC