Our Business, Mission & Strategy

Our Business

Our business is helping companies achieve new performance results by solving their most urgent problems and achieving their most valuable goals.

Our Mission

Our mission is helping our clients build thriving organizations that provide high value products to customers, rewarding employment to employees, and solid returns to stockholders.

Our Strategy

Our strategy is to help our clients achieve “leap-scale” performance improvements with our new methodologies, tools, technologies and AIM – Activity Information Modeling.

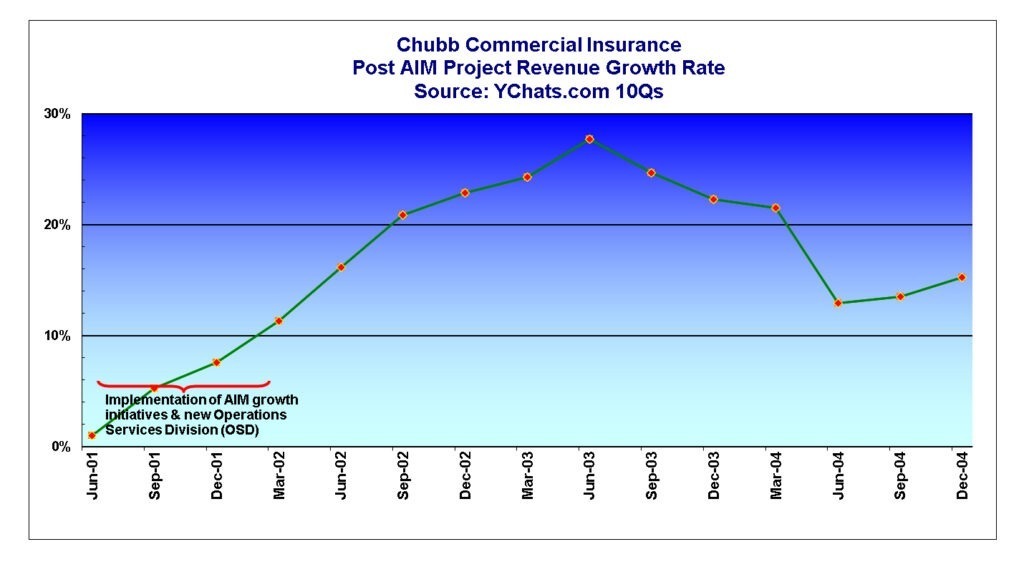

Chubb Commercial Insurance had 12 straight quarters of organic growth that exceeded 10% after conducting 2 AIM projects to increase productivity and growth. Seven of the 12 quarters exceeded 20%. During this same period the average growth rate for the commercial insurance industry was less than 1.5 %.

What We Do

We give our clients the ability to see everything that occurs in their company; why, when and how it occurs; how much time it takes and how much it costs.

We give our clients a multi-dimensional metrics blueprint with extensive information about their customers, products, processes and resources.

With this new and powerful information, we help them truly understand their performance, help them quickly solve their toughest problems and help them optimize their most valuable opportunities. Our clients achieve new organic growth, market strengths, and earnings.

We deliver our consulting services to our clients with new, unique and powerful management approaches, methodologies and technologies called Activity Information Modeling (AIM).

Who Engages Us

Where We’ve Worked

Many of our projects have been large scale, multinational projects where we simultaneously build AIModels across many countries in local languages while delivering mirror image AIModels in English for our client executives in the US and UK.

Among our largest projects have been an American bank’s 3,200 branches in the US and Canada, and a project involving over 40 countries in Europe, SE Asia, Middle East, and Latin America for a global insurance company.

What Our Clients' Success Looks Like

citibank

After seeing the cost of its customer segments in its customer and product AIModels, Citibank Private Bank raised its minimum assets on deposit from $2MM to $10MM for its North American and European customers. After this change, the bank doubled its assets on deposit in 18 months and doubled it again in the next 36 months. Profits more than tripled. They became one of the world’s largest private banking organizations and they have remained in that top tier.

AIG

AIG’s Global Claims Division conducted AIM projects to provide information for a Global Express Claims Program whose goal was to settle 50% of its claims within 24 hours of first notice. This program succeeded in reducing claims operations costs ranging from 38% to 62%. The company’s hyper-fast settlement services became a unique strength and keystone of a new marketing identity that helped many countries achieve and sustain double digit sales increases..

What Our Clients Say About Us

Having the exact costs also means that we can align our pricing by customer and product segment - which we're doing now. Plus, by saving FTE expense on incoming calls, those resources are being used for outgoing calls to support the customer intimate/high value-added effort to create high customer loyalty.”

“AIM lets us find the real reasons for how productivity can be truly improved, and costs can truly be reduced.”

“Because of AIM, we can now directly address changing the behaviors of Chubb and our agents to dramatically reduce redundancy, which will have a quick and direct effect on our costs and productivity.”

How We Do It

We build Activity Information Models of our clients’ Customers, Products, Processes, and Resources. Our AIModels give our clients NEW information specifically designed for their problems and goals. We lead our clients in the analyses of their problems, conduct scenarios analysis (what-ifs) and help our clients prepare new solutions that can be quickly and successfully implemented. Every AIModel is delivered with specialized Excel workbooks that make analyses and reporting easy for everyone in our clients’ organization.

This is our success formula:

R = id (Results = information X decisions)

ni X nd = NR (new information X new decisions = New Results)

To achieve new results, new decisions must be made with new information. It starts with new information; old information produces the same old decisions that produced yesterday’s old results.

Einstein said it well, “We can’t solve today’s problems with the mentality that created them.”

It All Starts With The Data

Traditional Consultants' vs. Our Approach

Traditional Consultants' Approach

Traditional management consultants gather existing information from their clients, hoping they can find something new that the client couldn’t. This existing information is almost always qualitative and never 100% homogenous. Clients’ existing information rarely has time and cost associated with it. Existing information almost always fails to provide everything that is needed.

Traditional consultants frequently supplement this old information with a small set of current observations and interview information which is qualitative, not quantitative. Observations and interviews are also very laborious, expensive, and time consuming to the project.

Traditional consultants collect descriptive data. It describes what happened and end results. It does not explain relationships and dependencies that predict what will happen if specific changes are made. Traditional consultants analyze their descriptive data and infer causes and relationships.

Our Approach

We create new information that is specifically designed to solve our clients’ problems and achieve their goals.

We collect new, quantitative and homogenous data from employees as they work. Our technology and methodology captures thousands of data points per hour.

We build AIModels with statistical confidence factors that exceed 98% and often exceed 99.5%. AIM data is never altered in any way and executives see a complete and accurate picture of their operations.

We collect descriptive data, diagnostic data, predictive data and prescriptive data. We know what happens, why it happens, how it happens and what it costs.

We never infer anything.

What Makes Us Better?

-

Our recommendations and implementation plans succeed at a +90% rate; they achieve all goals and expectations on time and within budget. Our AIM projects very frequently achieve results that far exceeds our clients’ initial goals.

Other consultants’ success rate hovers around 65%, according to Project Management Institute. McKinsey’s 2021 study said, “Our survey results indicate that companies’ transformation efforts remain stuck. The 30 percent success rate hasn’t budged after many years.” (Losing From Day One: Why Even Successful Transformations Fall Short. December 7, 2021 McKinsey & Company)

- One of the key contributing factors to our high success rate is our collaborative approach. From the first step of a project, and every step thereafter, we create a highly collaborative relationship that includes ownership and responsibility for the results among the clients’ employees.

We assign work tasks, and we lead clients’ employees to discover the causes of their problems and the possible solutions. Upon implementation these vested employees won’t let “their” new ideas and plans fail. These employees also have new knowledge and skills that they will use for the rest of their careers.

- Our projects’ results almost always exceed our clients’ goals because we discover problems and opportunities they didn’t know existed.

-

Our clients continue to use their AIModels for years to analyze and solve new problems. We have always offered future AIM analyses assistance at no charge.

- We conduct and lead our clients through a wide array of analyses. Other management consultants are not able to conduct these analyses because they do not have quantitative models.

-

- Descriptive analysis (what happens, defined with quantitative metrics)

- Diagnostic analysis (finding causes’, triggers’ and drivers’ quantitative dynamics)

- Predictive analysis (documenting dependencies, relationships, trends and forecasts)

- Exploratory analysis (looking at “under the radar” areas and testing imaginative “what ifs”)

- Prescriptive analysis (discovering solutions and improvement ideas)

- Metrics analysis (management performance metrics and ratios)

- Management analysis with decision tools (workforce management, cost management, etc.)

Einstein said:

Intellectuals solve problems, geniuses prevent problems.

We make our clients geniuses.

About Us

Orient Point Consulting LLC was founded in New York in 1997 by Gary Meyer.

Gary Meyer invented Activity Information Modeling in 1998.

Orient Point is the name of the northeast point of Long Island, New York, USA where we were founded and this lighthouse stands.

An “orient point” is also a navigation term. It is the “you are here” location where navigators orient their map and plot their course.

Your orient point is critical because you can’t get “there” from here if you don’t know where “here” is.

Orient Point was founded on these principles:

- New results are only achieved when managers have new information and make new decisions.

- The most successful consultants are able to solve the toughest problems because they gather specific, new information about the problem, they analyze scenarios with an open and independent mindset, and their findings and recommendations are not encumbered with restrictive assumptions or beliefs.

- Operational data must be quantitative. Qualitative data is often misleading, and even the best cannot be used for prescriptive or predictive purposes.

- Gathering sufficient data to understand a large complex problem and solve it without creating new problems, cannot be economically accomplished with manual methods. Gathering and assembling the amount and nature of the data can only be accomplished with sophisticated, automated, data collection technologies.

- Activity Information Modeling establishes that all organizational data is constructed into a molecular like structure. The activity is the nucleus, and data about resources, processes, products and customers, and all other attribute data surrounds the activity nucleus.

- Activity Information Modeling creates powerful information by calculating time, cost and incidence of thousands of data points.

- Orient Point believes that any manager who is given new, high-quality information along with powerful analytical tools and expert coaching, will develop better solutions and conduct faster implementations than the best consultants’ abilities.

About Gary Meyer

Gary Meyer’s first job interview after being discharged from the Army Security Agency was with Burger King Corporation in New York, who hired him that same day. At Burger King he developed a new and radically different workforce management program that was revenue-based. This new program significantly improved profitability, customer service and quality. It was very successful and was soon adopted by other fast-food companies. It has since become the standard workforce management method for the entire global fast-food industry.

He later joined Chatham Consulting Group, a New York operations consulting firm that worked with large financial service companies. Gary’s client assignments included AIG, Chase, Citibank, American Express, Swiss Bank, and the Federal Home Loan Bank.

Gary next joined Johnson & Higgins (J&H), a large global insurance broker/consultant where he formed an Operations Management Services department.

His strategies and programs doubled the Middle Market Division revenue (organic) in under 4 years and achieved industry leading profitability. He led the efforts to adopt and implement new technologies, including being one of 3 Lotus Notes development partners with IBM.

His re-engineering and performance management programs led J&H to achieve the highest productivity, profitability, and organic growth in the industry. They were featured in The Loyalty Effect, a book about ultra-high client retention, profitability, and organic growth strategies.

Johnson & Higgins merged with Marsh & McLennan, the world’s largest insurance broker/consultant, and he continued as VP of Operations Management Services until 1997 when he left to start Orient Point Consulting LLC.

Gary invented Activity Information Modeling in 1998 when networking and database technologies developed to the point where they could support his vision for an activity-based quantitative data model of large companies’ extensive & complex operations.

Orient Point’s first clients were Vytra HMO (Emblem Health), Chubb Insurance and Citibank. On their twentieth anniversary, they were still engaged by Citibank and Chubb Insurance, who had become the world’s largest commercial insurance company.

Gary Meyer served 5 years with the Army Security Agency (ASA), the field force for the National Security Agency (NSA), in Southeast Asia and Germany. He held Top Secret Crypto, Sigint, Humint, Special Intelligence and Code-Word security clearances. Gary is a service-disabled Vietnam War veteran.